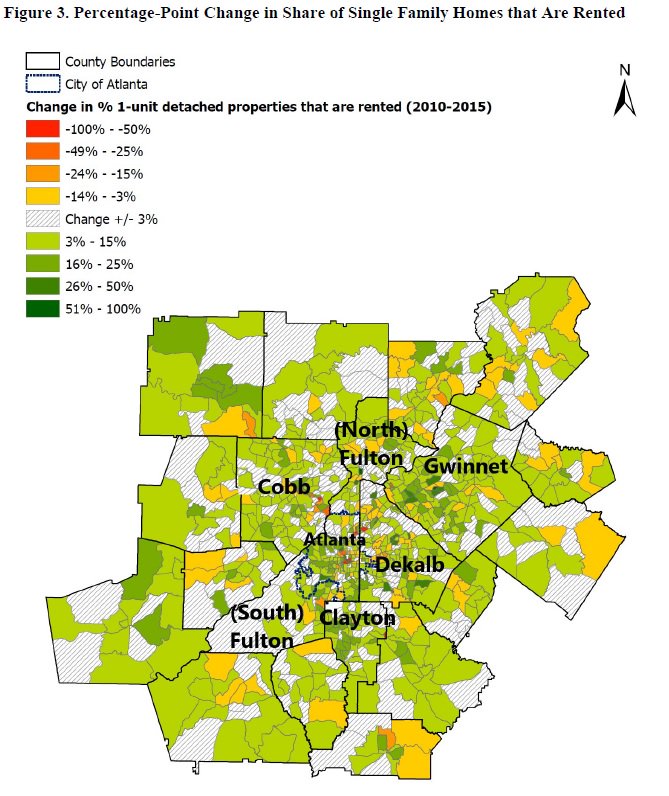

Atlanta Area Sees Spike In Single-Family Home Rentals

A study found a 67 percent increase in rentals of single-family homes in the five-county core Atlanta metro area between 2010 and 2015.

Reed Saxon, File / Associated Press

Atlanta is the top rental market in the country for single-family homes, mostly because of the 2008 recession.

A new study from Georgia State University finds these rentals are mostly in diverse neighborhoods.

Atlanta Foreclosures

After the foreclosure crisis, many Wall Street-backed institutional investors purchased homes along the Sunbelt – the Southern part of the U.S., where there was a high concentration of foreclosed homes and often fewer tenant protections and regulations, said Georgia State Urban Studies Institute professor Dan Immergluck.

In his new report, Immergluck found these homes, which are now for rent, are clustered in racially diverse areas of DeKalb, Fulton, Clayton, Cobb, and Gwinnett counties.

“Predominantly white neighborhoods are generally more resistant to rental housing,” Immergluck said.

Housing Options

Immergluck said home values in white neighborhoods are often higher, and there can be a stigma keeping renters out. But he said, with the rise in single-family rental homes, one positive aspect is more option for renters.

The study found a 67 percent increase in rentals of single-family homes in the five-county core Atlanta metro area between 2010 and 2015.

Real estate attorney David Cheng said most of his clients of diverse backgrounds are homeowners, but the Atlanta area economy and residents benefit from having more rental options.

“They may be here in one community renting now,” Cheng said. “As soon as they’re able to, they’re going to move back to homeownership, which is going to cause a lot of disruption within communities as people are moving in and moving out as they transition from homeownership and rentals back to homeownership.”