Georgia House GOP leadership seeks $1 billion income tax cut

Audio report by Rahul Bali.

Georgia’s House speaker on Tuesday proposed a $1 billion tax cut that would create a flat state income tax with a 5.25% tax rate, raise the amount of income exempt from taxation and eliminate many deductions.

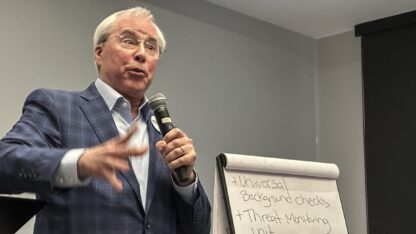

Speaker David Ralston and House Ways and Means Committee Chairman Shaw Blackmon, both Republicans, said the bill provides tax relief and simplifies Georgia’s tax system.

“This plan lowers the rate and significantly raises the standard exemption. It’s simple. It’s fair, and allows Georgians to keep more of their money,” said Blackmon, of Bonaire.

The changes would begin in 2024, meaning most taxpayers would see no difference until they file their taxes in 2025.

Georgia’s top income tax rate is now 5.75%, which applies to income over $7,000 earned by a single person or income over $10,000 earned by a married couple or a single person with dependents. Below that are a series of lower brackets created when typical incomes were much lower.

The Republican plan would wipe out those lower brackets, setting up a single rate of 5.25% and eliminating a number of deductions for people who itemize their income taxes. To offset what could be a tax increase on some low-income earners, the measure also increases the standard exemption to $12,000 from $5,400 for single people and to $24,000 from $7,100 for married people. The measure eliminates a separate standard deduction, which also allows a taxpayer to save money, rolling it up into the more valuable and higher standard exemption.

The bill would retain a $3,000 exemption per dependent, the ability to deduct charitable contributions if itemizing taxes, and exemptions for retirement and disability income and college savings plan contributions.

“A family of four for instance, will not pay one penny of income tax on their first $30,000,” Blackmon said, citing the $24,000 standard exemption plus $6,000 in dependent exemptions. He said a family of four that makes $50,000 would save $500 overall from today.

In 2018, the Republican-led General Assembly cut the state’s top income tax rate from 6% to 5.75%. Republicans had envisioned a second quarter-percentage decrease to 5.5%, estimated to cost $500 million, but the COVID-19 pandemic derailed those plans. Instead, last year, lawmakers raised the amount someone could earn before paying state income taxes, forgoing $140 million in revenue while saving individual tax filers up to $43 a year, and married couples up to $63.

Some lawmakers have proposed going further. Senate President Pro Tem Butch Miller of Gainesville has joined his fellow Republican candidate for lieutenant governor, Sen. Burt Jones of Jackson, in proposing to entirely abolish the state income tax, which provides roughly half of Georgia’s nearly $30 billion in state revenue.

Former U.S. Sen. David Perdue, the top Republican primary challenger to incumbent Gov. Brian Kemp, has also proposed abolishing the state income tax. Kemp has said he would work with Ralston on an incremental tax cut.

Ralston again rejected abolishing the income tax Tuesday, saying it would “blow a catastrophic hole in the state budget.”

“I think the responsible way to do it is through an incremental approach that we have adopted here in the House,” Ralston said. “I know it doesn’t fit on a bumper sticker quite as well.”

Cutting out even $1 billion from the state budget could pressure the state’s ability to keep up with a growing population in schools, universities and in the Medicaid health insurance program. Republican leaders expressed confidence that revenue would keep growing quickly and they would have time to plan for the changes.

Democrats, though, say Georgia’s bright budget picture presents a once-in-a-generation chance to improve government services that will disappear if Republicans reduce revenue with a tax cut.

“What happens when the money’s not there?” asked House Minority Leader James Beverly, a Macon Democrat. “They’re still going to have these families that are sick, still not going to have expanded Medicaid, still not going to have rural broadband. There’s a lot of things that we could do to build the infrastructure for the development of people in Georgia.”

Follow Jeff Amy on Twitter at http://twitter.com/jeffamy.