When a High Unemployment Rate Isn’t Bad and Low Gas Prices Aren’t Good

It might seem strange for an economist to say a state’s high unemployment rate isn’t necessarily bad.

Equally flummoxing? When an economist says falling gas prices aren’t necessarily good.An audio version of this report

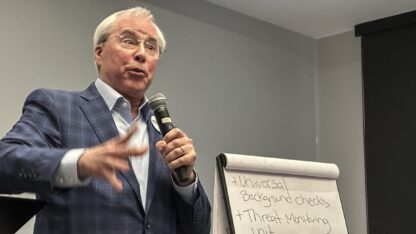

But both were points Georgia State University economist Rajeev Dhawan made Wednesday during his quarterly economic forecast.

Dhawan doesn’t dispute reports that Georgia has the nation’s highest unemployment rate. But he says the methodology used to come up with that rate doesn’t tell the whole story, thanks to a concept known as rotation group bias.

He says better economic indicators are state tax revenues (up 5.2 percent) and job growth (up 65,000). “Year over year, we’re doing better than the nation,” Dhawan said.

That slow but steady growth will likely continue, Dhawan said, as long as the global economy doesn’t get in the way. He pointed out that economic woes in China and Europe are already affecting Atlanta-based corporations. “Turner is doing some cutbacks [in] media,” he said. “Coca-Cola doing cost cutbacks. And, of course, our own Delta.”

Granted, Delta’s having a record year. But Dhawan said the airline’s best chance to grow its bottom line depends on demand for International travel.

And while consumers welcome recent trends toward lower gas prices, Dhawan said further drops likely mean the global economy is slowing. “Oil prices remaining so low is bad news for the overall economy,” he said, noting that consumers generally see lower pump prices as good news for their pocket books.

Dhawan also said housing starts, employment and personal income will all increase in the next two years, although not to pre-recession levels.

9(MDAxODM0MDY4MDEyMTY4NDA3MzI3YjkzMw004))