Republican Leaders Unveil Tax Reform Plan

Overhauling the state’s tax code – and in particular lowering the state income tax – has been a goal of Republican leaders for some time. This week, they unveiled a plan to do it.

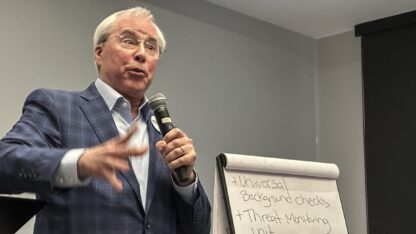

At a press conference flanked by House Speaker David Ralston, Rep. John Carson, R-Marietta said the time is now for major tax reform.

“We’ve had resolutions, we’ve had reviews, we’ve had councils, we’ve had committees for years … but I think people aren’t looking for more reviews. What they’re looking for is leadership,” said Carson.

Carson’s plan would lower the state income tax from six percent to four percent and raise the state sales tax from four percent to five percent. It would also eliminate dozens of tax breaks and reinstate the state sales tax on groceries for the first time since 1996.

Critics argue the outline of the plan is regressive and would hit lower-income people harder.

Carson countered that the poorest Georgians, like those on food stamps, won’t be affected.

“Under the federal law, we’re not allowed charge sales tax on food stamp purchases anyway,” said Carson. “What I would say is families making $29,000 or more are going to see an income tax reduction and more take-home pay.”

Speaker Ralston wouldn’t commit to a timeline for the bill, saying it’s better to get it right, then to do it quick.

9(MDAxODM0MDY4MDEyMTY4NDA3MzI3YjkzMw004))