Proposed Repeal Of Jet Fuel Tax Rankles Clayton Schools Officials

Clayton school officials say a bill that would repeal a state tax on jet fuel unfairly targets their district.

A bill advancing through the Georgia House would repeal the state tax on jet fuel. House Bill 821 has irked Clayton County school officials, who say it would strip the district of $20 million dollars and future E-SPLOST (Education-Special Local Option Sales Tax) revenue.

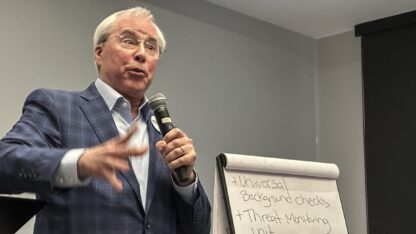

Rep. Chuck Efstration, R-Dacula, is the bill’s sponsor. He says the purpose of the legislation is to boost economic development.

“Georgia currently has the fourth-highest jet fuel sales tax among the 21 states with major hub airports,” Efstration says. “Other states in the South, including North Carolina and Texas, have zero jet fuel sales tax.”

Efstration says the Clayton school district has been illegally collecting revenue from the tax. He’s referencing a mandate from the Federal Aviation Administration that requires municipalities to spend money collected from local jet fuel taxes on aviation. Clayton County is challenging that requirement in court.

Clayton Schools Superintendent Morcease Beasley says the bill unfairly targets his school system.

“You don’t support increases in profits of corporations on the backs of children,” Beasley says. “We need a solution that does not disproportionately impact—negatively impact–Clayton County.”

Beasley says the bill would likely force the district to delay capital building projects. He’s organizing a meeting this weekend to urge residents to oppose the legislation.

Meanwhile, the House Ways and Means Committee approved the bill Thursday. The full House is scheduled to vote Monday.