Georgia House Panel Approves Bill Allowing Sports Betting

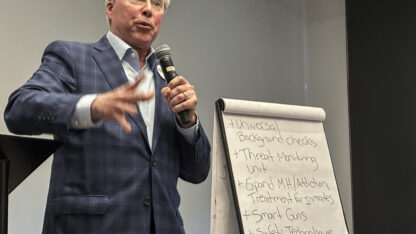

Georgia House Economic Development and Tourism Committee Chairman Ron Stephens, left, a Savannah Republican, talks Tuesday to Democratic state Reps. Calvin Smyre, center, of Columbus, and Al Williams, of Midway, in Atlanta after the committee approved a bill to legalize sports betting in Georgia. Stephens says taxing sports betting could provide more than $40 million a year for college scholarships and preschool subsidies.

Jeff Amy / Associated PRess

A bill that would legalize sports betting in Georgia and give tax revenue to the state lottery is in advancing in the state House, despite questions about whether a state constitutional amendment would be required to do so.

The House Economic Development and Tourism Committee voted 20-6 Tuesday to approve House Bill 86, sending it to the full House for more debate.

The measure would mandate that the Georgia Lottery Corp. give at least six licenses to companies that want to offer sports betting in Georgia. After the companies pay out bettors’ winnings, the state would tax the remaining proceeds at a 14% rate. Committee Chair Ron Stephens, a Savannah Republican, estimates that at even a 10% tax rate, that would bring in $42 million to increase funds available for HOPE college scholarships and state subsidies for prekindergarten classes and child care.

In addition, each operator would have to pay a $900,000-a-year license fee.

Atlanta’s four major league professional sports teams are seeking the bill. Stephens cited their “massive economic power,” saying teams haven’t been able to fill stadiums.

“It’s for fan participation,” Stephens told the committee. “As I said earlier, the stands are empty. … They believe that fan engagement is what sports betting is all about.”

Stephens, citing an American Gaming Association study, said millions of Georgians place billions of dollars of sports bets each year illegally.

“We can legitimize it, if you will, through the lottery,” Stephens said. “If you’re going to do it offshore, why don’t we collect the revenue here in Georgia?”

Stephens expressed confidence that lawmakers could authorize the Georgia Lottery Corporation to offer sports betting. Voters authorized the lottery by state constitutional amendment in 1992. Others, including some state government lawyers, have questioned whether that would be legal, suggesting another constitutional amendment would be needed. Any such measure would require the approval of two thirds of each house of the General Assembly, followed by majority approval of Georgia’s voters.

The bill proposes allowing people 21 and older to bet. It would not allow betting on college or high school sports, and would prohibit betting on certain events such as injuries.

Opponents, though, say state-sponsored gambling encourages addiction and other social harms. They also don’t want to open the door beyond Georgia’s already massive lottery, saying they’re trying to avoid legislative support for a constitutional amendment allowing casinos.

“They should think this is terrible because it’s going to accentuate everything that’s negative about predatory gambling,” said Mike Griffin of the Georgia Baptist Mission Board, which lobbies for the state’s largest Christian denomination.

Griffin said he’s particularly worried about provisions that would allow betting on electronic sports.

“All this is going to do is prime children to get ready to gamble one day,” Griffin said.

People can currently bet on sports in 21 states and the District of Columbia, with five more states having moved to legalize gambling but not yet taking bets. Not all of those states allow online betting, as is envisioned in the Georgia proposal, with some requiring gamblers to physically go to casinos, horse racing tracks or other places. Among Georgia’s neighboring states, Tennessee allows online betting, while North Carolina is moving toward allowing in-person betting at two Cherokee-operated casinos.

The committee voted without allowing testimony from interested parties and without considering amendments, although a number of members expressed interest in amendments. Stephens said he anticipated a House-Senate conference committee if the bill moves forward and would consider possible changes sought by members while negotiating with senators.

Stephens said state Sen. Jeff Mullis, a Chickamauga Republican, is expected to carry a bill in the Senate that would propose a 10% tax rate and could allow wagering on collegiate sports. That legislation has not yet been filed. Stephens had originally proposed a 16% tax rate before lowering his plan to 14%. However, he characterized a 10% tax rate as too low.