Georgia Reaps $2.2B Surplus Even After Rainy Day Fund Fills

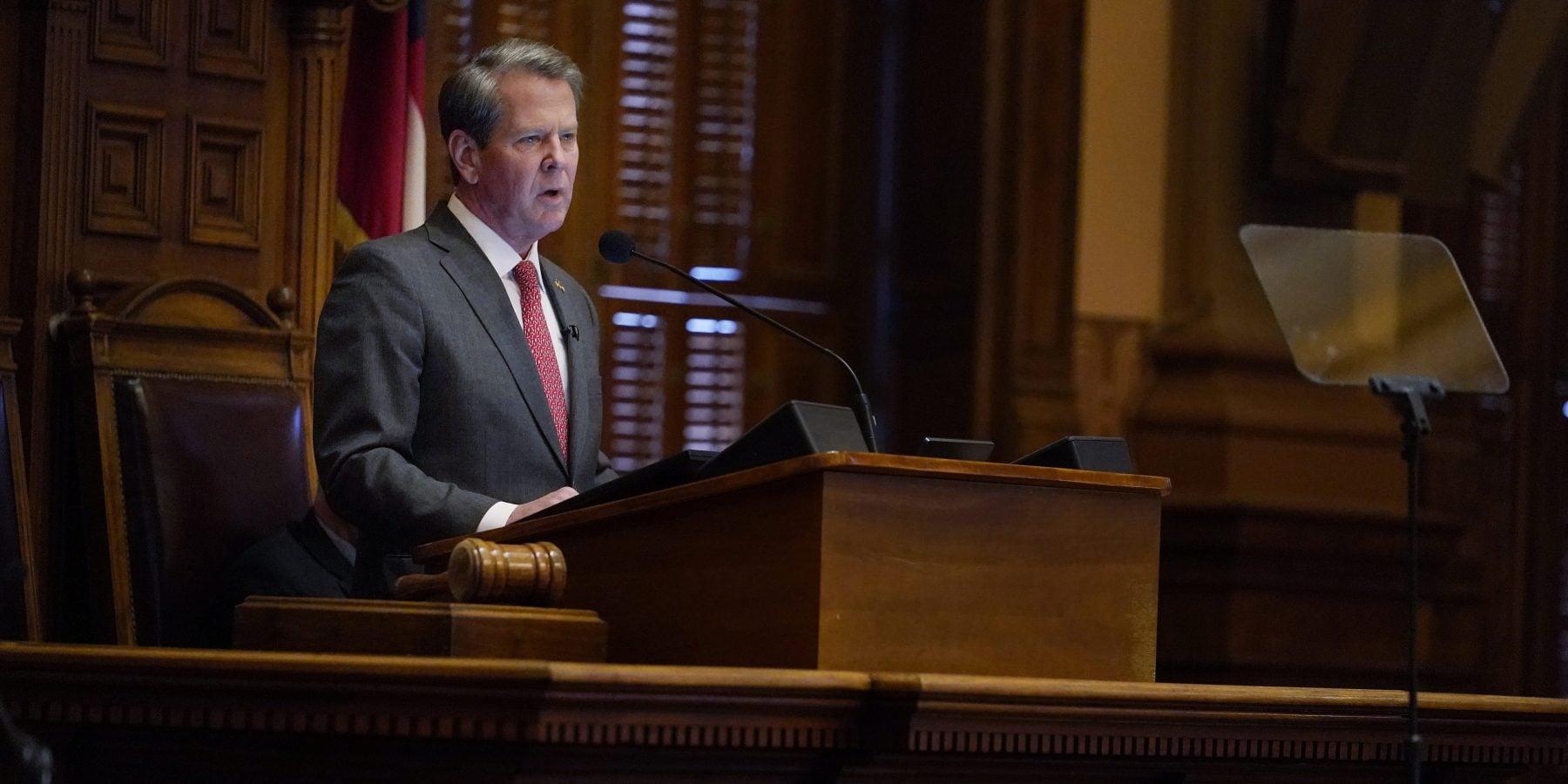

Gov, Kemp must decide if he wants lawmakers to spend the unprecedented $2.2 billion in “unreserved, undesignated” surplus when he sets the revenue estimate next January.

Pixabay Images

Georgia has more money in the bank than ever before, creating a chance for an election-year spending or tax-cutting spree — if that’s what Gov. Brian Kemp and Republican lawmakers want.

Figures released Monday show the state ended the 2021 budget with a nearly $2.2 billion surplus even after the state’s rainy day fund was filled to the legal limit of $4.3 billion. That’s a big turnabout from cuts imposed by state lawmakers who cobbled together the 2021 budget amid pandemic uncertainty in June 2020.

It’s the first time the state has filled its rainy day fund, meant for budget emergencies, since lawmakers raised the limit from 10% of yearly revenue to 15% in 2010. That move aimed to provide more cushion after the Great Recession devastated state tax collections, forcing steep spending cuts. Georgia hasn’t run a surplus on top of a filled rainy day fund since before the recession, officials said earlier this year.

The Republican Kemp must decide if he wants lawmakers to spend the $2.2 billion in “unreserved, undesignated” surplus when he sets the revenue estimate next January. Lawmakers can’t spend more than what Kemp allows.

Kemp says his approach of allowing businesses to operate freely despite the pandemic deserves credit for strong revenue and low unemployment “despite an unpredictable global pandemic.”

“Thanks to the conservative leadership and fiscal responsibility of the Governor and the General Assembly, Georgia is on strong financial footing,” spokesperson Katie Byrd said in a statement Monday.

Georgia’s budget pays to educate 1.7 million K-12 students and 435,000 college students, house 45,000 state prisoners, pave 18,000 miles (29,000 kilometers) of highways and care for more than 200,000 people who are mentally ill, developmentally disabled or addicted to drugs or alcohol.

Lawmakers cut 10% from the 2021 spending plan, about $2.2 billion, fearing revenue would plummet. Once it became clear they wouldn’t, about $650 million was put back before the end of the year. That money restored more than half the cuts to Georgia’s K-12 school funding formula, although schools were left about $400 million short of what the formula demands.

For the current budget year that began July 1, lawmakers approved spending $27.3 billion in state tax money and $49.9 billion overall, once federal and other funds are included. But state funding didn’t get back to the $28 billion originally projected for 2021. The K-12 funding formula is again crimped by cuts and most other agencies didn’t get back any money slashed from the 2021 budget. In July, budget director Kelly Farr again instructed agencies to not ask for more money in 2023.

Lawmakers could restore the K-12 formula to its full amount, although Republican leaders have noted that federal pandemic aid meant most schools had plenty of cash.

Republicans have continued to downplay expectations for spending, with House Appropriations Committee Chairman Terry England saying the surplus could be used to cover long-term costs for health care for retired teachers and state employees. The most recent projection shows Georgia $20 billion short of those costs. England also suggested that the money could be used to build a reserve for the state employee health plan, helping it to avoid future rate increases.

“My tendency is to want to put some more in reserve before saying we need to open it up,” England, an Auburn Republican, said Monday.

But with tax revenue already running 6% ahead of last year through the first two months of the 2022 budget, others are likely to be ready to spend more or cut taxes.

“I think you’re going to see a lot of debate on that,” said Senate Appropriations Committee Chairman Blake Tillery, a Vidalia Republican.

Kemp promised teachers a $5,000 pay raise when he got elected and has so far delivered $3,000. The remaining $2,000 was estimated to cost $350 million in 2020.

Republican House Speaker David Ralston of Blue Ridge has advocated for a further cut in the state income tax, a proposal priced at $250 million in foregone revenue in 2020. Other priorities could include a pay raise for state employees, more spending on mental health and restoring other agency cuts. Democrats want to expand Georgia’s Medicaid program to cover more uninsured adults.

“It is time to expand Medicaid,” Senate Minority Leader Gloria Butler, a Stone Mountain Democrat, said in a statement. “More than decade later, it’s time to fund our public schools, and it’s also time to put the brakes on any schemes that benefit only the top wage earners.”

Besides the regular budget, Kemp will get to decide how to spend $4.8 billion in federal pandemic aid. State officials recently extended the deadline for applications.