The FDIC Wants To Fix The Unbanked Problem In Atlanta

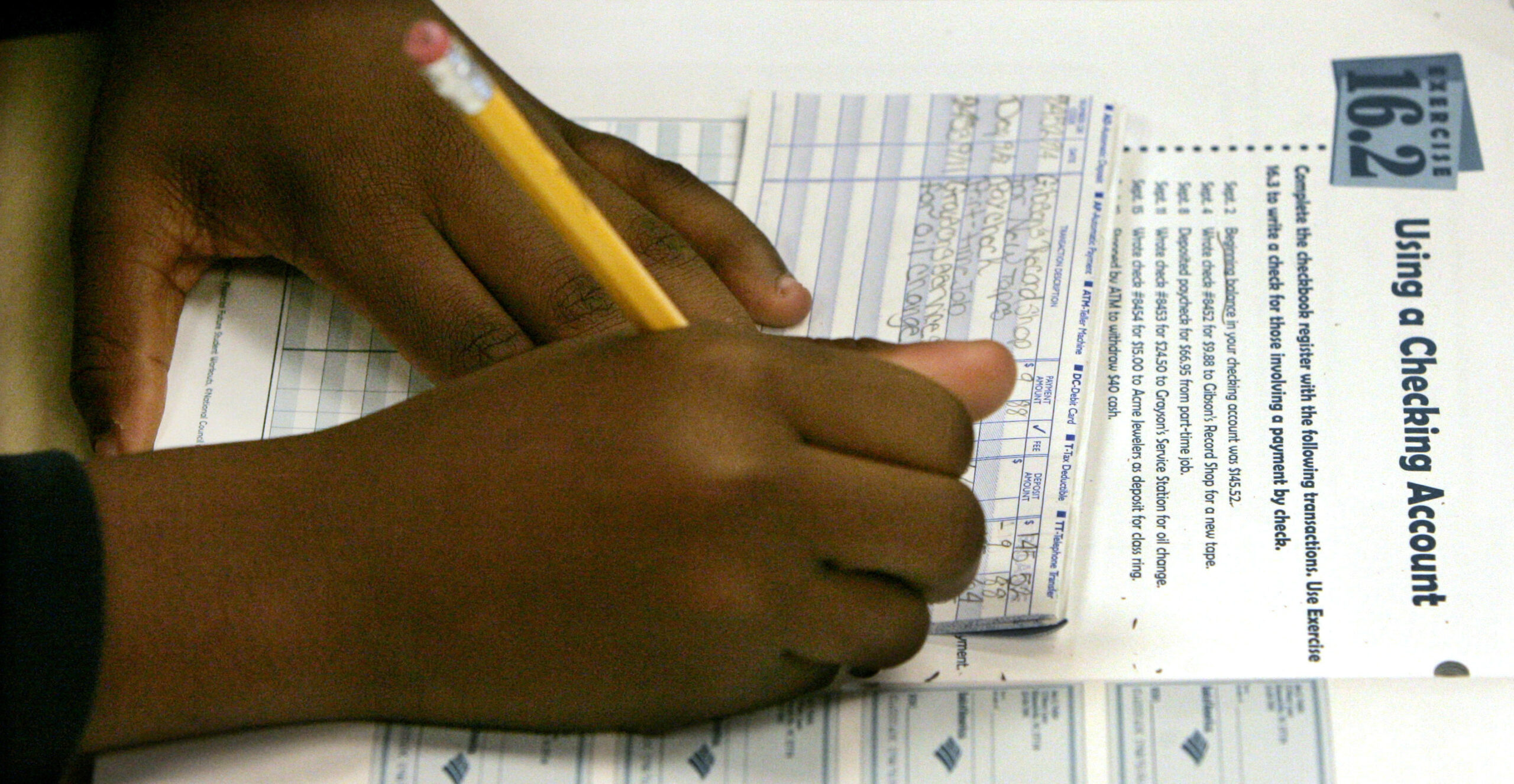

In this file photo, a sixth-grader balances a checkbook ledger during a personal finance class. The share of households that are unbanked is much higher in Black and Hispanic communities, according to the FDIC. The racial disparity in access to bank accounts is particularly severe in Atlanta.

Charles Rex Arbogast / Associated Press file

The FDIC wants more people in Atlanta to open bank accounts.

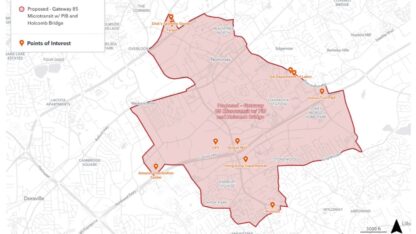

The federal deposit insurance agency launched an awareness campaign Tuesday that aims to reach disproportionately Black and Hispanic unbanked populations in Atlanta and Houston with information about the benefits of using a bank account.

The initiative to reduce the number of unbanked households is an uncommon move by the agency and the focus fell on Atlanta because research found its racial disparities are particularly severe.

Across the nation, 5.4% of American households were unbanked in 2019, according to a survey from the FDIC. This means that in 7.1 million U.S. households, no one had a checking or savings account at a bank or credit union.

While the number of people who are unbanked has been on the decline over the last decade, the data shows the rate of households without a bank account is much higher for Black and Hispanic communities.

Nearly 14% of Black households and 12% of Hispanic households in the U.S. were unbanked in 2019, compared to just 2.5% of white households.

Managing finances without a bank account can be more expensive, requiring extra fees to cash checks.

This problem became more urgent during the pandemic as the federal government began to distribute relief funding to individuals.

To read the full article, go to Atlanta Business Chronicle>>