Metro Atlanta Seminars, Online Tools Help Explain New Tax Reform

Many news outlets have reported that this has been the most comprehensive reform of the country’s tax code since 1986.

J. Scott Applewhite / Associated Press file

Update on Feb. 5, 2018, 2:50 p.m.: Lisa Wright’s seminar that was scheduled for Feb. 8, 2018, in Stonecrest, Georgia, has been postponed until further notice.

The deadline for filing taxes is April 17, and with the new Republican-backed tax reform in place, a lot is expected to change.

Many news outlets have reported that this has been the most comprehensive reform of the country’s tax code since 1986.

Lisa A. Wright, a certified public accountant and founder of L.A. Wright & Associates in Lithonia, says many people may not see the impact of the new tax reform until Feb. 15.

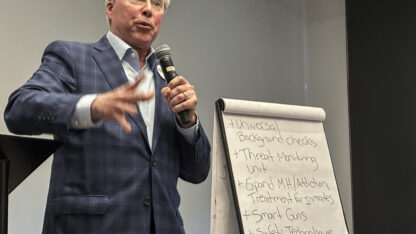

According to her biography, Wright is a sought-after panelist and speaker. She is among the money experts who are giving their input and speaking at free seminars across metro Atlanta, hoping to educate people on the new tax law.

“(The new tax bill) is a really big game-changer,” Wright said at a lunch-and-learn workshop Wednesday. “Make sure you get with someone who will educate you about your taxes.”

Wright’s advice is to stay engaged and plan ahead.

“Stay engaged,” she added. “Get involved. Do not rely on what you hear on the news bites.”

Tax Plan Calculators

Calculators that estimate the impact of the tax reform on individuals have been circulating on the internet. Wright said she had reviewed some of these tools and thinks that they can be used as a general guide to understand the new tax law.

Some media outlets, including CNN and the New York Times have published these tools online. Market Watch, the Tax Foundation and the Tax Policy Center also have their own versions.

The calculators ask for information about your salary, number of children, if you itemize or if you are married, single or the head of your household.

Nonetheless, Wright added, these tools will never take the place of another person processing your tax returns or what is actually going to show up on your W-2.

Other Advice

Wright added that it was important to keep detailed records of your expenses, especially if you want to get a refund. She said don’t just say you took someone out on a work-related lunch; keep records of where and when you went.

Check the Better Business Bureau and ask for references when you are seeking out a tax-planning professional, Wright said. Avoid people who will promise to take care of all your taxes at an extremely cheap price. Wright said the processing alone usually costs $50.

“Have the person tell you the true cost of getting a refund,” she added. Consider additional fees to processing your taxes.

Some Seminars, Workshops In Metro Atlanta

Wright will be speaking at another seminar soon. There are more events taking place in the metro Atlanta area, some of which are free to the public.

Below is a list of some upcoming seminars in metro Atlanta that have been advertised on Facebook, Eventbrite and organizations’ websites.

Accounting and Tax Insights for Creatives

When: Jan. 30, 6:30 to 9 p.m.

Where: Reformation Brewery in Woodstock

Registration: Free

This event is mostly geared toward freelancers and entrepreneurs. Tax expert Greg Dangar of Dangar Associates will be presenting.

When: Feb. 6, 10:30 a.m. to 1:30 p.m.

Where: C4 Atlanta

Registration: $25 for C4 Atlanta members and $35 for nonmembers.

Hosted by C4 Atlanta, a nonprofit that helps local artists get business training, this class will educate attendees on the new tax law and give them insights into Georgia’s business structures, according to the event description.