Equifax Launches Free ‘Lock & Alert’ Mobile App

“Lock and Alert” is Equifax’s new mobile app and service.

Courtesy of Equifax

Atlanta-based Equifax launched a new mobile app and service Wednesday called “Lock and Alert.”

It’s in response to a massive cyberattack disclosed on Sept. 7 that exposed sensitive personal information like Social Security numbers of more than 145.5 million people.

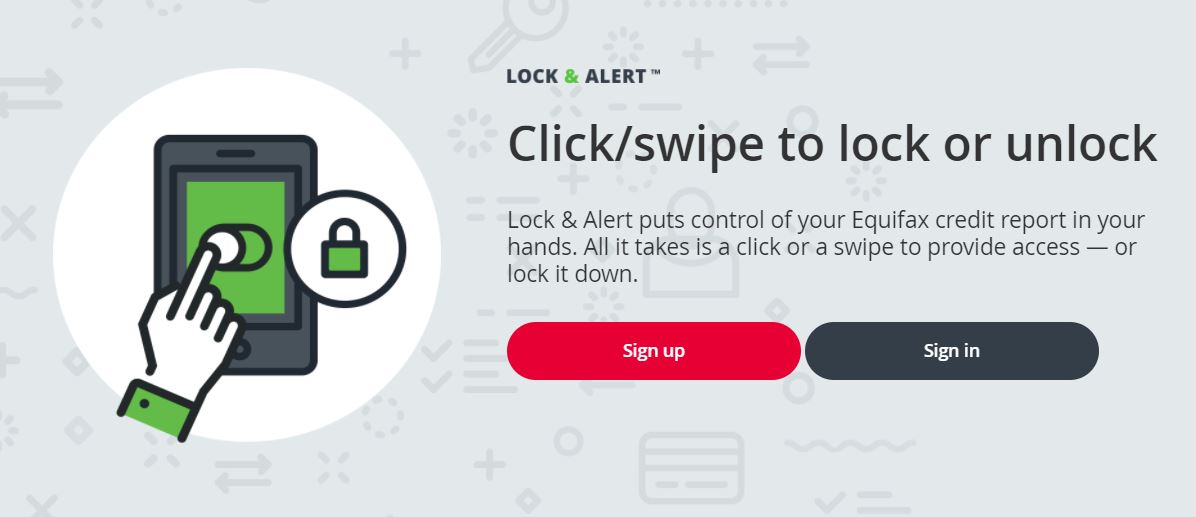

The new free lifetime service lets users lock and unlock their credit reports to keep people from accessing the personal information in their credit history.

Credit bureau expert John Ulzheimer, who used to work at Equifax and FICO, said what’s also new is that the mobile app allows you to do it on your phone.

“It’s as simple as locking and unlocking your Equifax credit report by simply swiping left or right, which is certainly more convenient than how you would have to unfreeze your credit report, which is not app-based,” Ulzheimer said.

Security Strategy

Humayun Zafar, a Kennesaw State University associated professor for information security, said the other two credit agencies Transunion and Experian need to follow its lead.

“It’s not a bad service, but unless someone signs up for all three of those it really does not make sense to sign up for one of those,” Zafar said.

Zafar said the three credit agencies need to cooperate on a security strategy because they all have similar data and people can’t opt-in or out of these agencies handling their data.

A credit lock is similar to a credit freeze, but you won’t need a pin number to unlock your credit files, and you won’t have to pay the fee, usually $2 to $10 depending on the state you live in, to freeze and unfreeze credit.

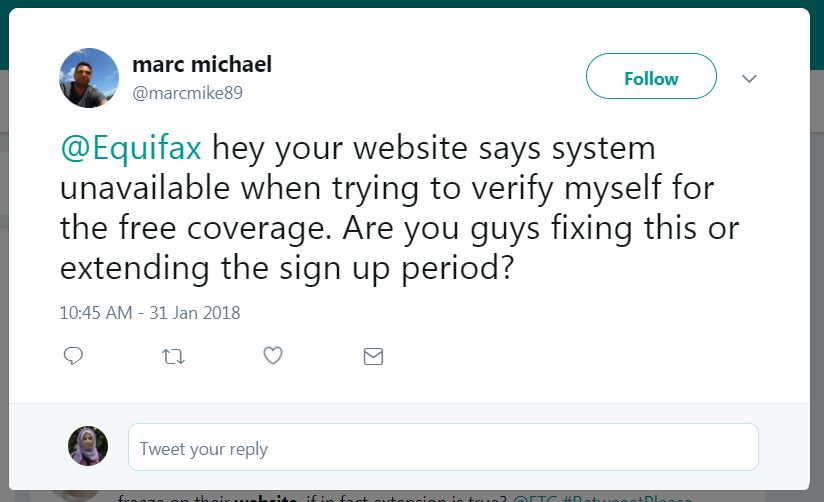

Equifax announced it will extend free credit freezes until June 30.

The deadline to sign up for one year of free credit monitoring services that it offered after the breach was made public is Jan. 31.

Rollout Issues

Zafar and others reported they had issues signing up for the free lifetime service when it was first launched on Jan. 31.

Smyrna resident and energy technology consultant Rex Arul said he had trouble signing up multiple times.

“Equifax’s response to this whole thing has been pretty ostentatiously underwhelming,” Arul said. “I hope they extend the deadline [for free credit monitoring] or address it as any company should: with integrity.”

Professor Zafar, who leads the mobile application development center at Kennesaw State University, said he felt it was clear the company did not do enough quality testing with this “Lock & Alert” website and smartphone app. He noted the website allowing people to check if they were impacted shortly after the breach was made public last fall was also problematic.

“They’ve had issues with rolling out since the breach was first made public,” Zafar said. “Right at the beginning, folks had the option of typing in their Social Security number. Even I tried it out where I randomly punched in a Social Security number and it told me I was impacted and I punched in the same number a second time and it said I was not impacted.”

Paulino do Rego Barros Jr. first announced the service as “long-term support” in a Wall Street Journal op-ed on Sept. 27, one day after he was named Equifax’s interim CEO.

“The surveys that have been published on this issue suggest that people have largely forgotten about the Equifax data breach and never really did much about it,” Ulzheimer said. “I hope that because the freezes are now going to be free into June and now the lock will be free forever. I hope that someone who was looking at cost as a hurdle to sign up for one or the other will now go ahead and do so because it is a very effective way to protect your credit reports.”