Audit: Ga. Tax Exemption For Farmers ‘Vulnerable To Misuse And Abuse’

Under the GATE program, Georgians who produce at least $2,500 worth of agricultural products per year don’t have to pay the sales tax on farming equipment and supplies.

Pixabay Images

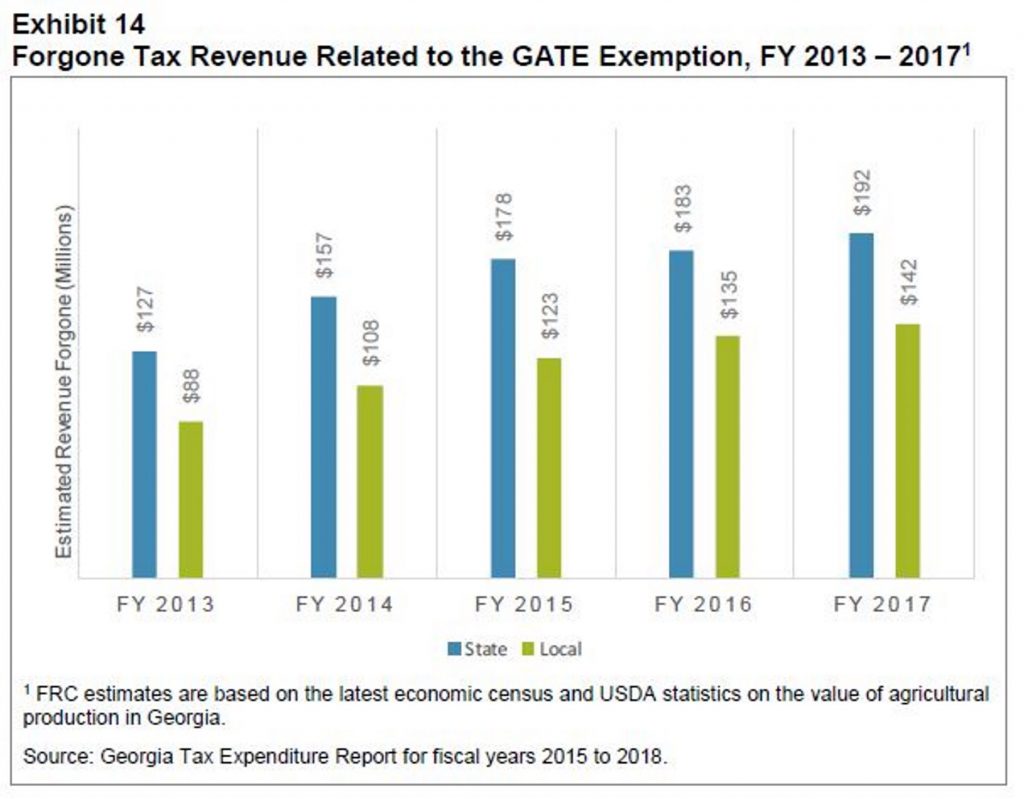

A $300 million Georgia program meant to save farmers money on everything from tractors to pigs is susceptible to fraud, according to state auditors.

The Georgia Agriculture Tax Exemption (GATE) was already the target of criticism from some local government officials in rural parts of the state who contend it further depresses their sluggish sales tax revenues.

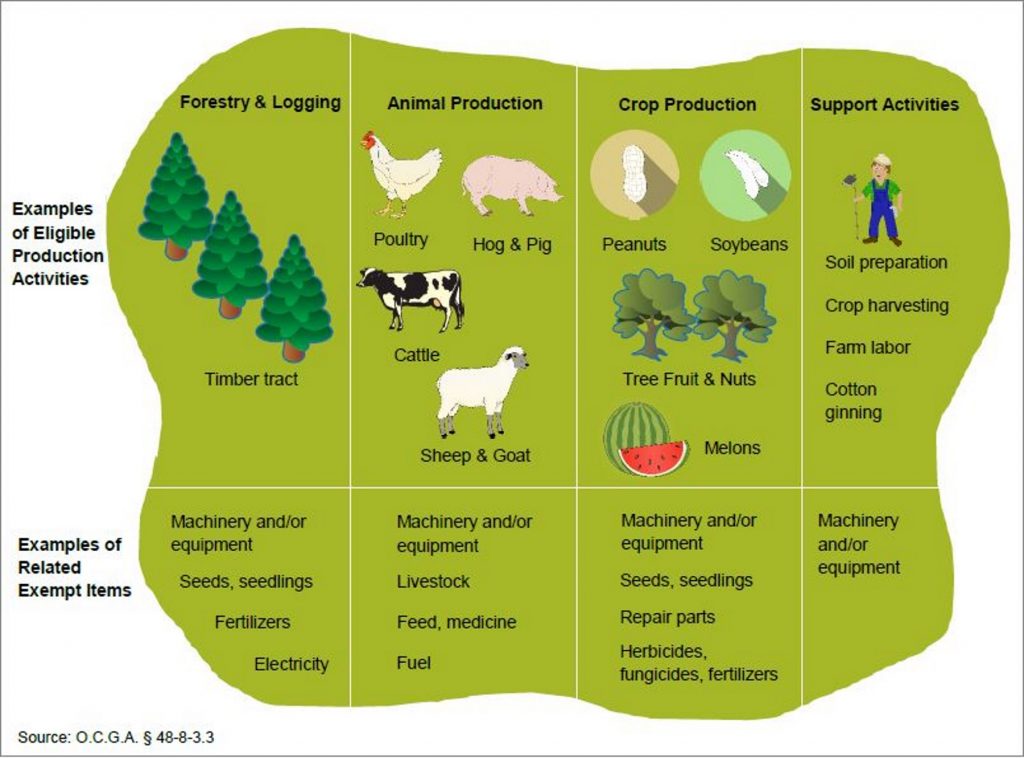

Under the GATE program, Georgians who produce at least $2,500 worth of agricultural products per year don’t have to pay the sales tax on farming equipment and supplies. Livestock, fuel, machinery, seeds and fertilizer are some examples of what’s exempt.

Sales tax exemptions for farmers have been around since the 1960s. The GATE program consolidated them in 2013, with overwhelming approval from the Georgia Legislature. Today, nearly 40,000 Georgians are enrolled in the GATE program, which the Department of Agriculture administers.

“Lack of enforcement leaves the program vulnerable to misuse and abuse,” a recent state audit said.

The audit called the $2,500 threshold for eligibility in the program “low,” citing a risk “cardholders near the threshold can fall out of eligibility after receiving the card.”

“The GATE application does not collect the necessary information, such as income for each industry an applicant is engaged in, to properly assess eligibility,” the audit said.

Chas Cannon, who holds a GATE card himself, said he frequently hears stories of people abusing the program.

“You’ve got what they call ‘hobby farmers,’ which are not really big farmers. They’re kind of small, maybe 5 to 10 acres, and that GATE card allows them to buy basically anything that goes into that ‘farm’ at a 0 percent sales tax rate,” Cannon said.

“Not everybody is going to be honest when they’re trying to buy products in the market,” he said. “They’re going to say, ‘Well, this light bulb is for my farm, my barn or whatever,’ and that’s going to be a sales-tax-exempt item, and it goes into their house, their personal residence.”

Cannon is the administrator of Colquitt County in South Georgia. Ninety percent of the county is zoned for agriculture, he said, and people there spend lots of money on farming supplies and equipment. It would mean a lot of sales tax revenue for the county, but because of the GATE program, the money doesn’t come in.

“We’re already kind of behind in terms of trying to compete,” Cannon said. “If you continue to take away more and more revenue from these small, rural, local governments, it makes it harder and harder for them to dig out of a hole.”

Cannon said the county has trouble hiring law enforcement officers, and it can’t afford to pay them a competitive wage. The county doesn’t have the money it needs to repave roads or attract new companies, he said.

Cannon had recommendations for changes to the GATE program. He suggested increasing the threshold, so farmers have to produce a higher value of agricultural products to be eligible. Cannon also suggested letting counties decide whether they want to allow the exemption.

Skeetter McCorkle, another GATE cardholder, is part owner of a plant nursery in McDuffie County, near Augusta. The nursery has been open for 75 years.

“We grow a broad range of ornamental plants: azaleas, hydrangeas … those types of plants,” McCorkle said.

Not paying the sales tax is key to his business, McCorkle said.

“I think there probably are some losers, but a significantly larger amount of winners,” he said. “All in turn, it should be a win for our farmers. It should be a win for our state.”

Abuse of the GATE program is illegal and wrong, McCorkle said, and the state audit shows there’s a need for tweaks.

“You hear, ‘Don’t abuse the GATE program.’ That’s become almost a mantra,” McCorkle said. “No doubt, there are a few bad actors, and they should be dealt with, and I think that’s important for the integrity of the system.”

The lawmakers who sponsored legislation creating the GATE program did not respond to requests for comment or could not be reached.

The Georgia Department of Agriculture said it does not have a mechanism to securely maintain tax documents necessary to validate applicants’ information, and it supports some legislative changes to the GATE program.