In Georgia, Latinas are starting companies at a rapid pace, but these businesses need more support to face the challenges at the intersection of gender and ethnicity.

A robot that looks like a Roomba with multiple shelves, a couple of feet tall, rolls through a Mexican restaurant in Roswell, delivering chips and salsa to customers.

Kettybot, or Ketty for short, is one of the server bots sold by Marianela Nanninga. And she says it tells “jokes.”

“I asked God for advice, but I know God doesn’t work that way. So I stole a bike and asked for forgiveness,” said Ketty.

The Venezuelan-Italian entrepreneur started her tech company, ToDo Robotics, in Georgia almost two years ago.

Nanninga is multi-lingual and says that has come in handy.

“A lot of my clients are Mexican guys. So they are very happy to understand that I can actually talk to them and I can communicate without problem with the personnel,” said Nanninga.

According to a recent Stanford study, Latinas are the country’s fastest-growing segment of entrepreneurs, contributing billions to the economy.

But Nanniga says finding funding to start her business was tough.

“It was the moment to present, launch, and request money for the corporation. So, we prepared a business plan, the marketing plan, everything, all the documentation. We presented the project, and guess what? The company said ‘no.’ And I was heartbroken,” said Nanninga.

She is not alone in this, either.

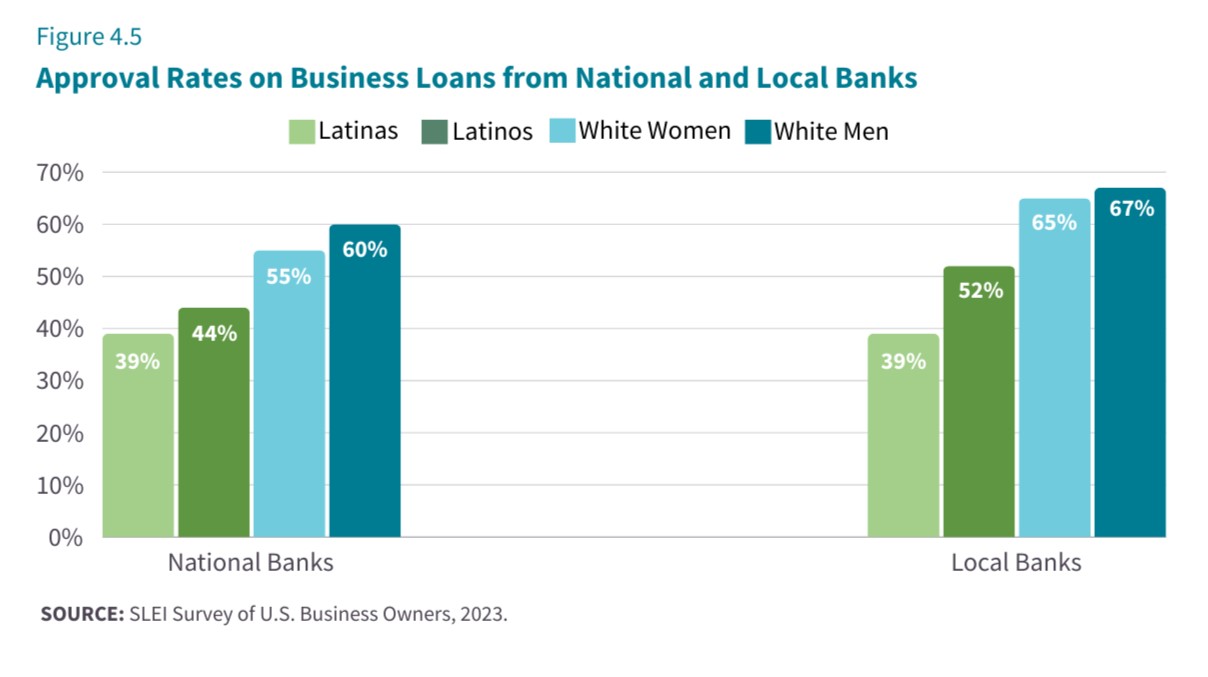

According to Stanford’s 2023 State of Latino Entrepreneurship report, Latina business owners seek financing at high rates yet receive the lowest loan approval rates from local and national banks at just 39%.

That’s why Lisa Guadalupe Clarke says she founded her nonprofit, Latinas Rise.

“And I found a lot of Latinas calling me and asking me, Lisa, do you know who could help my business with a non-traditional loan?” said Guadalupe Clarke.

She says while there are organizations dedicated to helping small business owners, without fair access to lending or government contracts, these entrepreneurs are left out of essential funding opportunities.

“We need help growing our business. We’re really good at starting, and we’re doing great. But now we need to take our business to the next level,” said Guadalupe Clarke.

The Stanford report also found between 2007 and 2022, there was a 57% increase in Latino-owned businesses, compared with just a 5% increase in White-owned businesses.

“Latina-owned employer businesses are really at the forefront of business creation, especially when we think about women enterpreneurs,” said Barbara Gomez-Aguinaga, associated director for the Stanford Latino Entrepreneurship Initiative.

“In 2023, Latina entrepreneurs were the most likely to actually want to get financing. So, they were the most likely to seek financing in 2023, more so than any other group. But at the same time, they had the lowest loan approval rates,” said Gomez-Aguinaga.

Gomez-Aguinaga says Latinas are often overlooked when applying for traditional business funding methods. The study revealed that many of them turn to credit cards to support themselves, building debt they would later have to pay back with interest.

“Looking back at our research, Latinos were heavily impacted during the pandemic. But the fact that the number of Latinos continues to rise just shows the resilience of this community,” said Gomez-Aguinaga.

She says one of the ways this community has remained resilient is through the help of community-based organizations.

“Throughout the years, when we’ve done this research, we found that Latino-owned businesses engaged with organizations that support Latino enterpreneurs are actually more likely to succeed,” said Gomez-Aguinaga.

The Georgia Hispanic Chamber of Commerce celebrates 40 years of supporting the Latino business community this year.

Jeimy Arias is a business coach who runs her own firm and partners with the Chamber of Commerce.

“The great thing is that there’s a lot of empowerment in a lot of those women. They’re taking advantage of those opportunities to help them take their business to the next level,” said Arias.

Arias, also known as Coach Jeimy, says there is something special about the moment we’re in.

“When we, as women, start a business, we’re giving our best, our best skills, our knowledge. And there’s a lot of talent in women,” said Arias.

Latinas in Georgia are showing up across many industries, like tech and construction. Support for established and new businesses will remain critical as the Hispanic population in Georgia is set to rise.

”Last year, we spearheaded a cohort for young entrepreneurs,” said Nathaly Loaiza, co-owner of CAL Heating & Cooling Solutions and one of the directors of Hispanic Young Professionals & Entrepreneurs (HYPE).

Loaiza says expanding the resources available to the community in the state will remain key as we see more entrepreneurs step up to the plate.

“So to be in a room, (woo) to be in a room with all these entrepreneurs having like that drive and that passion, it’s inspiring to witness that there are young people coming out here [and] Latina entrepreneurs moving forward and going for what they want,” said Loaiza.