More orthopedic physicians sell out to private equity firms, raising alarms about costs and quality

This report was brought to you by WABE content partner, Kaiser Health News. You can read the original version here.

Dr. Paul Jeffords and his colleagues at Atlanta-based Resurgens Orthopaedics were worried about their ability to survive financially, even though their independent orthopedic practice was the largest in Georgia, with nearly 100 physicians.

They nervously watched other physician practices sell out entirely to large hospital systems and health insurers. They refused to consider doing that. “It was an arms race,” Jeffords said, “and we knew we had to do something different if we wanted to remain independent and strong and offer good quality of care.”

So, in December 2021, Resurgens sold a 60% share in United Musculoskeletal Partners, their own management company, to Welsh, Carson, Anderson & Stowe, a large New York-based private equity firm known as Welsh Carson. Although details of the sale were not disclosed, physician-shareholders in deals like this typically each receive a multimillion-dollar cash payout, plus the potential for subsequent big payouts each time the practice is sold to another investor in future years.

Orthopedic surgeons, long seen as fiercely independent, are rapidly catching up with other specialist physicians, such as dermatologists and ophthalmologists, in selling control of their practices to private equity investment firms. They hope to grab a bigger chunk of the surging market in outpatient surgery and maintain their position as one of the highest-paid specialties in medicine — $633,620 was the average compensation for orthopedists in 2021. For older doctors, the upfront cash payout and the potential second payout when the business is flipped offers the promise of a posh retirement.

Proponents say private equity investment has the potential to reduce total spending on musculoskeletal care and improve quality by helping physicians move more procedures to cheaper outpatient surgery centers, which have less overhead. It also could help the doctors shift to value-based payment models, in which they charge fixed amounts for whole episodes of care, such as total joint replacements and spine surgeries — receiving bonuses or penalties from insurers based on cost and quality performance.

But critics warn that profit-hungry private equity ownership alternatively could result in higher prices for patients and insurers, more unnecessary surgery, and less access to care for patients on Medicaid or those who are uninsured or underinsured. A recent study found that in the two years after a sale, PE-owned practices in three other medical specialties had average charges per claim that were 20% higher than at places not owned by private equity.

Critics also worry that PE investors will put pressure on doctors to see more patients and use more non-physician providers in ways that could lead to poorer care, as KHN has reported about gastroenterology and other specialties.

“Private equity has no interest in reducing the cost of medicine,” said Dr. Louis Levitt, chief medical officer of MedVanta, a Maryland orthopedic management company whose physician-owners have rejected partnering with private equity. “Their goal is to increase profitability in three to five years and sell to the next group that comes along. They can only do it by making the doctors work longer and reduce service delivery.”

There are now at least 15 PE-backed management companies — called platforms — that own orthopedic practices across the country, said Gary Herschman, a New York lawyer who advises physicians in these deals. The first orthopedic deals were done in 2017, and dozens of sales have occurred since then, with the pace expected to quicken. In 2022 alone, at least 15 orthopedic practices were sold to PE-owned management companies.

Dana Jacoby, CEO of the Vector Medical Group, a strategic consultancy for physician groups, said several orthopedic platforms built by private equity investors already are on the market for resale to other investors, though she wouldn’t say which ones. The government does not require public reporting of these deals unless they exceed $101 million, a threshold that is adjusted over time.

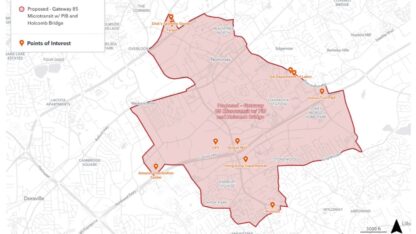

Private equity investors have rolled up orthopedic practices in at least 12 states, with concentrations in Georgia, Texas, Florida, and Colorado.

Besides United Musculoskeletal Partners, other sizable PE-owned orthopedic platforms include Phoenix-based HOPCo, backed by Audax Group, Linden Capital Partners, and Frazier Healthcare Partners, with 305 physicians in seven states; Alpharetta, Georgia-based U.S. Orthopaedic Partners, backed by FFL Partners and Thurston Group, with 110 physicians in two states; and Fort Lauderdale, Florida-based Orthopedic Care Partners, backed by Varsity Healthcare Partners, with 120 physicians in four states.

Private equity funds, with a reported $1.8 trillion to invest in health care, are attracted to the size of the orthopedic care market. Annual patient spending is nearly $50 billion alone for treating back pain. The soaring demand of aging Americans for joint replacements, the high rates insurers pay for musculoskeletal procedures — such as nearly $50,000 for a knee replacement — and the lucrative array of orthopedic service lines and ancillary businesses, including ambulatory surgery centers, physical therapy, diagnostic imaging, pain management, and sports medicine, make this a tantalizing line of business.

The standard playbook of private equity firms is to pull profits of 20% out of their physician groups each year, then reap up to a 350% return on their cash investment when they sell the platform, say experts involved in these deals.

Orthopedic surgeons “are very excited about getting a $5 million to $7 million check,” said Dr. Jack Bert, former chair of the practice management committee of the American Academy of Orthopedic Surgeons. “But some I’ve talked to say the suits come in and tell the doctors, ‘You’re not working hard enough, you’ve got to increase production by 20%.’ That can be a big problem.”

Through their sale to Welsh Carson, the Resurgens orthopedists in Atlanta got a capital partner and executive expertise to help them expand by acquiring other orthopedic practices in Georgia and other markets. Soon after the deal, United Musculoskeletal Partners acquired large orthopedic practices in Dallas and Denver, and brought in a second private equity firm as an additional investor. Several other acquisitions are imminent, said Sean Traynor, a general partner at Welsh Carson.

The investment capital and the company’s growing size in major markets will sharpen the doctors’ ability to negotiate richer contracts with insurers, get better deals on equipment and supplies, build more outpatient surgery centers, and improve quality of care for patients.

The physicians, Traynor said, retain full responsibility for clinical governance, and that is protected by a permanent contract provision binding on all future owners.

“Other physicians ask what’s changed [since the sale], and I say nothing, which is great,” said Dr. Irfan Ansari, one of the Resurgens orthopedists.

But some large employers, whose self-funded health plans pay for orthopedic care for their workers, view the trend toward private equity ownership warily. They fear the new owners will milk the current fee-for-service system, which financially rewards doctors for providing more — and more expensive — surgical procedures, rather than promoting less costly but effective services such as physical therapy for lower back pain.

“The worry we have is we’re not seeing private equity fulfilling the promise of value-based care,” said Alan Gilbert, vice president for policy at the Purchaser Business Group on Health, which represents nearly 40 large private and public employers. “We’re seeing the same short-term financial goals you see with other private equity investments, including pressure to perform non-indicated procedures.”

At least two PE-backed orthopedic groups, however, are working with insurers on cost-saving value-based care programs. U.S. Orthopaedic Partners and HOPCo tout their partnerships with insurers, boasting that they’ve built systems to deliver entire episodes of care at lower costs under fixed-payment models.

Jennifer Allen, chief financial officer at Blue Cross & Blue Shield of Mississippi, said her health plan has saved nearly 40% by collaborating with Mississippi Sports Medicine, now owned by U.S. Orthopaedic Partners, on bundled payments for hip, knee, and shoulder replacement procedures as well as several spine procedures. But Allen said the program was launched in 2016 before private equity investors bought that orthopedic group.

“We had established the protocols, the benefits, the bundle, and everything before that,” she said. “I didn’t see anything that the private equity platform brought to the table.”

Dr. David Jacofsky, HOPCo’s chairman, said private equity owners should be steering their orthopedic groups toward value-based care, but so far he’s not seeing that happening much. “Private equity has lofty goals of wanting to build these things, but the time frame it takes is much longer than private equity wants to stay in these deals,” he said. Instead, he added, most are trying to grow bigger and demand higher payments from insurers, and “that’s not good for anyone.”

Still, MedVanta’s Levitt isn’t optimistic about his orthopedic colleagues’ ability, or willingness, to resist private equity. “We’re on an island and pieces are being chipped away by piranhas in the water,” he said. “I’m not sure it’s possible to remain independent.”