Tax Relief Bill Passes Georgia Senate, But Democrats Say There’s A Better Path

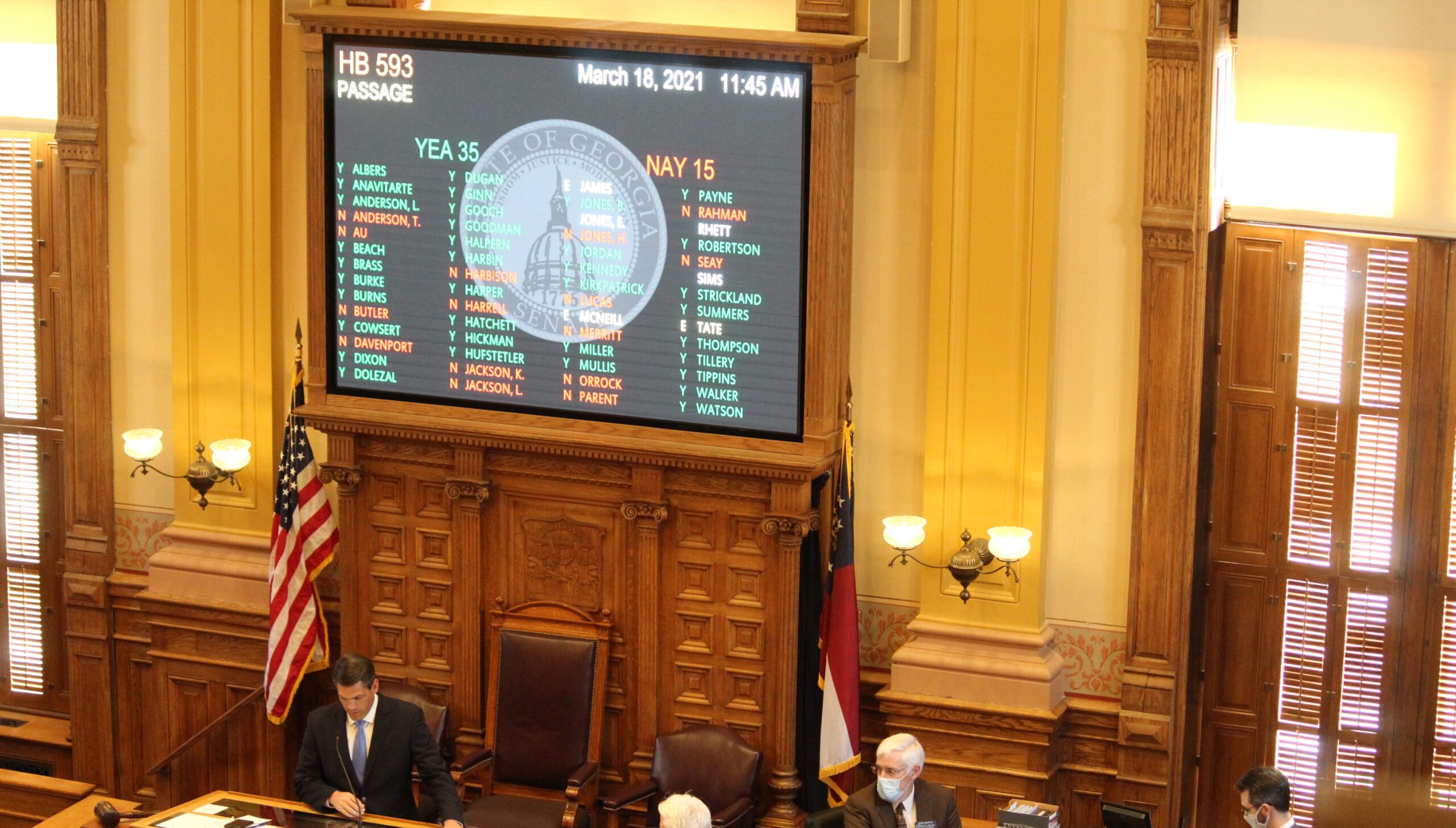

House Bill 593, passed by the Georgia Senate on Tuesday, raises the standard tax deduction. But Democrats say there are ways to save residents more money.

Emil Moffatt / WABE

Legislation that would increase Georgians’ standard tax deduction has passed the Georgia Senate and is now on the precipice of becoming law.

But Senate Democrats who opposed the bill say the tax relief represents only a quick fix when residents of the state could experience larger savings and financial benefits if Georgia were to fully expand Medicaid, among other measures.

The debate on the Senate floor turned into a passionate partisan affair over the role of government.

“I am just really shocked that my colleagues across the aisle have basically gotten up here and said we’re for bigger government and higher taxes,” said Republican Sen. Larry Walker. “That’s essentially what they’ve said, and I think that’s very clear.”

But Democratic Sen. Nan Orrock dismissed the argument that government not expand the services it offers to Georgians.

“They want excellent public schools, strong public safety, good hospitals, a health care provider system that works for everybody, access to insurance, a livable wage,” said Orrock. “An ability to raise your children in a society that’s moving forward and that the children are going to do better than you did. And they don’t do that without the vital role of government.”

House Bill 593 raises the standard deduction by $800 for single individuals and $1,100 for couples filing their taxes jointly. Some Democrats joined Republicans in passing the measures, but 15 did not. The bill now heads to the governor’s desk.

Adding to Democrats’ objections is uncertainty over whether new tax relief at the state level will put federal relief funds from the American Rescue plan in doubt.

Democrat Elena Parent says a direct payment instead of tax cut would let the state avoid being penalized.

“If we do it as a direct payment, we won’t have any question that Georgians will still get the money, and we will still get the money, the $140 million [in federal relief money]. Instead of doing that, we’re like a teenager jumping up and down [saying], ‘You can’t tell me what to do. I’m gonna go ahead and do it,’” said Parent.

Walker said an opinion from the Treasury Department indicated that states wouldn’t be penalized for lowering taxes if they offset those cuts with savings elsewhere in the state budget.

Meanwhile, House Bill 114, which passed unanimously, increases the annual tax credits for families who adopt foster children from $2,000 to $6,000 for the five years after adoption. The credit then reverts to $2,000 until the child turns 18 years old.